THANK YOU FOR YOUR REQUEST

Thank you very much for your interest in EIDETIC MARKETING.

We look forward to working with you.

We will contact you soon.Thanks Again.

THERE WAS A PROBLEM WITH YOUR SUBMISSION.

Have you checked all the required fields?

We want you to write your Company, Name, E-mail, Budget, Country to Execute, Website URL, Wanted Services and Project Description.Thanks.

Monthly Archives: February 2026

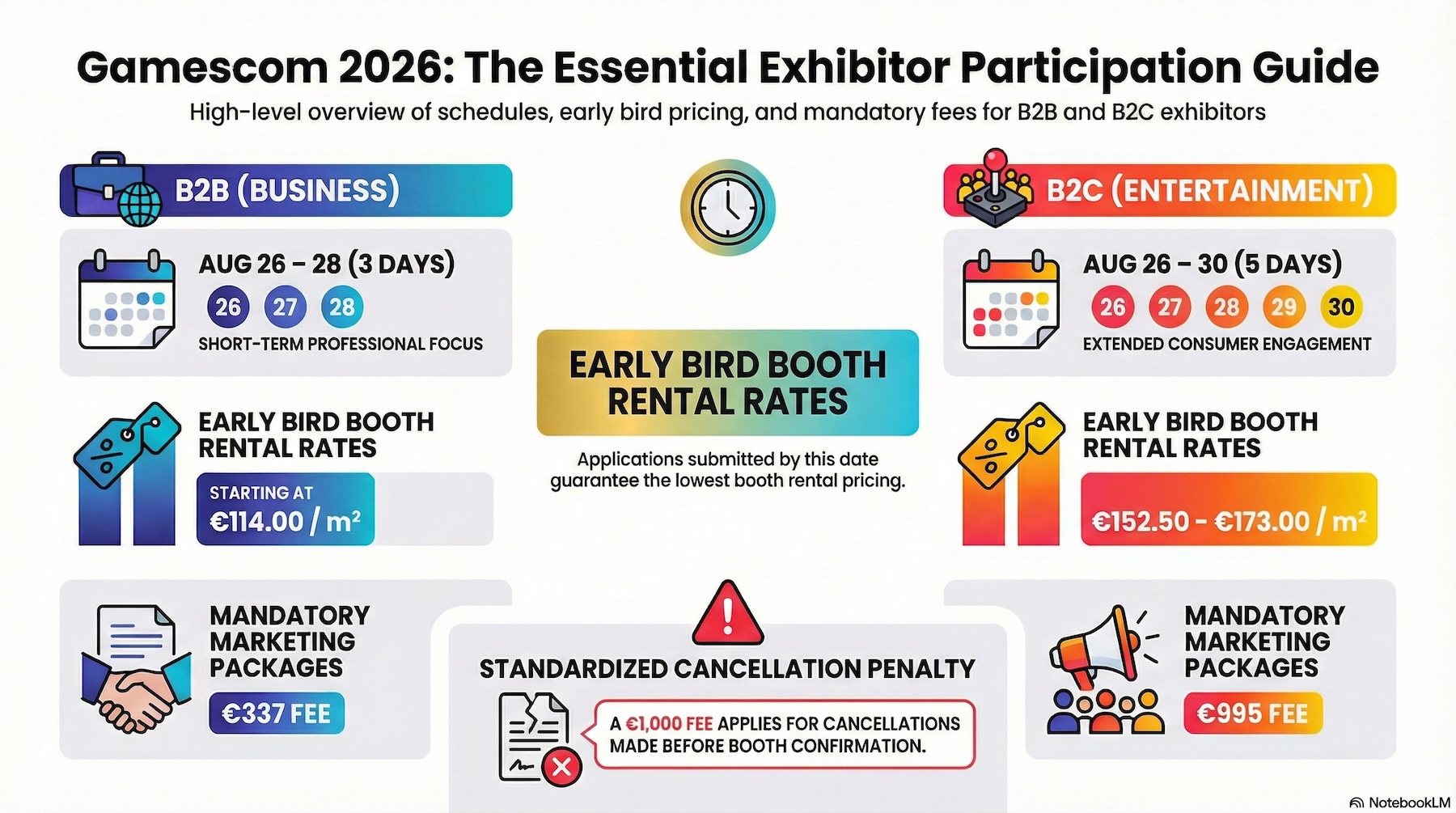

Gamescom 2026: Everything Exhibitors Need to Know

February 18, 2026

From early bird registration to on-site strategy — everything you need to know about Gamescom 2026, Europe’s largest gaming event.

Gamescom 2026 Everything Exhibitors Need to Know

Why Gamescom 2026 Should Be on Your Radar

Gamescom 2026 is shaping up to be the most ambitious edition of Europe’s largest gaming event yet. Held every August at the Koelnmesse complex in Cologne, Germany, Gamescom has become the definitive stage where the gaming industry reveals its future. With record-breaking attendance of 357,000 visitors from 128 countries in 2025 and over 630 million digital impressions worldwide, this is no longer just a European trade show — it is the stage where the gaming industry reveals its future.

For studios, publishers, and gaming brands aiming to reach both industry professionals and passionate consumers, Gamescom 2026 offers unmatched dual access to B2B and B2C audiences in a single event. Whether you are launching a new title, scouting partnerships, or building brand awareness on a global scale, a presence at Gamescom 2026 could be the most impactful marketing investment you make this year.

Why Gamescom 2026 Is the One Event You Can’t Skip

Gamescom 2026 is Europe’s largest gaming event — and after a record-breaking 2025, expectations are higher than ever. If you’re a studio, publisher, or gaming brand looking to reach both industry insiders and consumers on a global stage, Gamescom 2026 is the most cost-efficient, high-reach event on the calendar.

Gamescom 2025 at a Glance

Before planning for 2026, it helps to understand just how big Gamescom has become.

| Metric | 2025 Figure |

|---|---|

| Venue | 233,000 m² across Koelnmesse |

| Total Visitors | 357,000+ from 128 countries |

| Exhibitors | 1,568 companies from 72 countries |

| B2B Trade Visitors | 34,000+ |

| Opening Night Live Views | 72 million (live) |

| ONL Total Online Reach | 630 million+ impressions |

These numbers make one thing clear: Gamescom is no longer just a European trade show. It is one of the most-watched moments in the global games calendar.

Gamescom 2026 Key Dates & Schedule

| Program | Dates |

|---|---|

| gamescom dev (formerly devcom) | August 23–25, 2026 |

| Opening Night Live | August 25, 2026 (evening) |

| Business & Media Day | August 26, 2026 |

| B2B Days | August 26–28, 2026 |

| B2C / Public Days | August 26–30, 2026 |

| Venue | Koelnmesse, Cologne, Germany |

B2B runs Wednesday through Friday — dedicated to publishers, platform holders, press, and investors. B2C opens Thursday through Sunday, bringing in hundreds of thousands of consumers ready to play, react, and share. One event, two entirely different audiences.

gamescom dev (the former devcom conference) now runs under the Gamescom umbrella — a useful pre-show window for developer-focused networking and sessions before the main event begins.

Opening Night Live 2026

Opening Night Live (ONL) is the annual pre-show broadcast hosted by Geoff Keighley. In 2025 it drew 72 million live viewers and 630 million total online impressions — making it one of the highest-reach moments in gaming media.

Sponsorship in ONL is a separate investment from your booth, with minimum eligibility requirements (B2C booth of 100 m²+ or an official B2C activation).

ONL 2026 Integrated Airtime Rates

| 30 sec | 60 sec | 90 sec | 120 sec | 150 sec | 180 sec | |

|---|---|---|---|---|---|---|

| Pre-show | €63,000 | €92,000 | €120,000 | €150,000 | €180,000 | €210,000 |

| Main Show | €155,000 | €225,000 | €300,000 | €370,000 | €440,000 | €510,000 |

ONL sponsorship is best suited to brands with a major announcement or launch timed to Gamescom — the audience is already primed for reveals.

Booth Registration for Gamescom 2026

The single most impactful decision you’ll make is when you register. Early bird applicants get approximately €15/m² off the standard rate and, more importantly, priority booth placement — high-traffic locations go fast.

Applications are submitted through the official Gamescom exhibitor portal and go through a review process before hall and location assignments are made. Companies with consecutive years of participation often receive preferential placement.

Booth Registration & Location Tips

Gamescom 2026 Exhibitor Checklist

- • Register early — save on costs and lock in a prime location before inventory runs out.

- • Define your objective — B2B deal-making, consumer activation, media coverage, or all three? Your goal determines everything from booth size to staffing.

- • Build a demo-first experience — hands-on content consistently outperforms passive displays in footfall and social sharing.

- • Coordinate logistics early — Cologne has strict build-up schedules and customs requirements for international shipments. Factor these in from the start.

- • Align your digital strategy — Gamescom generates massive social buzz. Plan your influencer outreach and press moments around the event window.

- • Book accommodation immediately — with 357,000+ attendees, hotels in Cologne fill up months in advance.

Make Gamescom 2026 Your Biggest Stage Yet

EIDETIC is a global experiential marketing agency specializing in gaming and tech events. Our edge at Gamescom comes from three things:

- ✔️In-house production — strategy, design, and fabrication handled internally, not outsourced.

- ✔️Local team in Germany — staff based in Cologne who know Koelnmesse, its regulations, and its logistics inside out.

- ✔️Gamescom veterans — we’ve been on this show floor across multiple editions. We know what works, what doesn’t, and how to avoid the surprises that derail first-timers.

Whether you’re exhibiting for the first time or scaling up an existing presence, we handle the complexity so your team can focus on what matters: the show.

FIFA Brand Guide for World Cup Sponsors

February 9, 2026

FIFA Brand Guide for World Cup Sponsors

Every World Cup sponsor receives the FIFA brand guide.

Along with the scale of global exposure, sponsors are also expected to operate within a highly structured system.

The guide defines how sponsor branding is handled across official World Cup environments.

It applies beyond logos and visual assets, shaping how brands are named, positioned, and presented in front of fans throughout the tournament.

For many sponsors, this is where the gap appears.

The opportunity is clear, but the practical constraints are not always easy to navigate.

Having worked within this system at the 2022 Qatar World Cup, and now preparing World Cup marketing for an official sponsor of the 2026 tournament, we have seen where those constraints tend to surface in practice.

This article looks at that gap, focusing on how the FIFA brand guide is typically applied once sponsor activities move into official, fan-facing environments.

Because of this scope, the guide can be useful to look at as more than a reference document, especially once activations move into official environments.

The FIFA brand guide is not limited to visual consistency.

It establishes how the World Cup brand and sponsor brands are allowed to coexist within the same system.

Rather than offering flexibility, the guide defines clear boundaries.

These boundaries become most visible when sponsor branding appears alongside official FIFA assets in public and fan-facing environments.

Understanding this structure is essential before moving into execution.

FIFA Brand Guide 1) Composite Logo

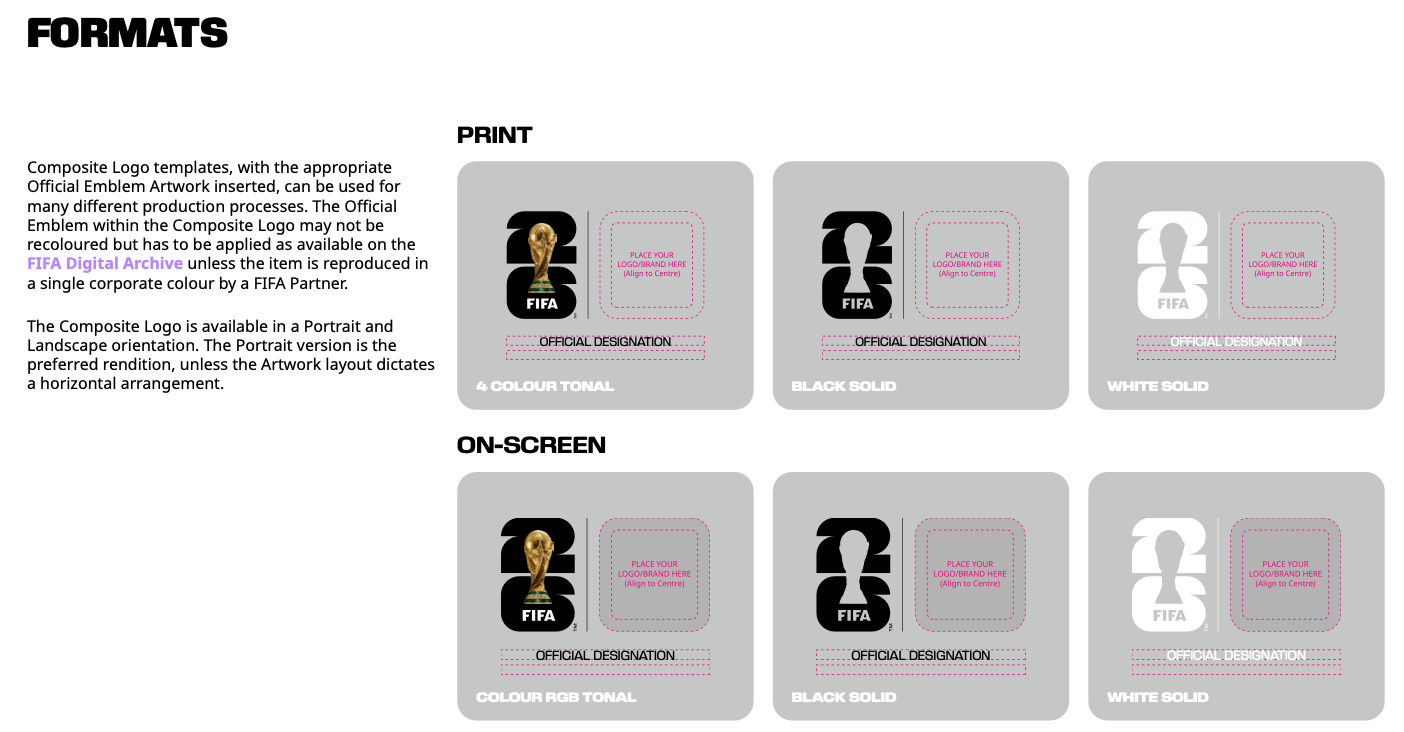

The composite logo defines how sponsor logos may appear in relation to official FIFA World Cup emblems.

When a sponsor logo is combined with a FIFA asset, the relationship must be clearly structured.

This includes fixed alignment rules, divider lines, and official designation language that explains the sponsor’s role.

The composite logo system ensures that sponsorship relationships are communicated accurately, without implying ownership or organizational authority over the tournament.

Composite Logo Brief

- • When combined with a sponsor logo, the official emblem sets the baseline for logo size.

- • For print materials, the minimum size is defined as 15 mm in height and 9 mm in width for the emblem.

- • Clear space around the emblem must be secured based on the height of the FIFA “F”.

- • Shadow effects and gradients are not permitted, and the divider line cannot be removed, except in approved animation cases.

- • Care should be taken not to omit the legal “TM” designation.

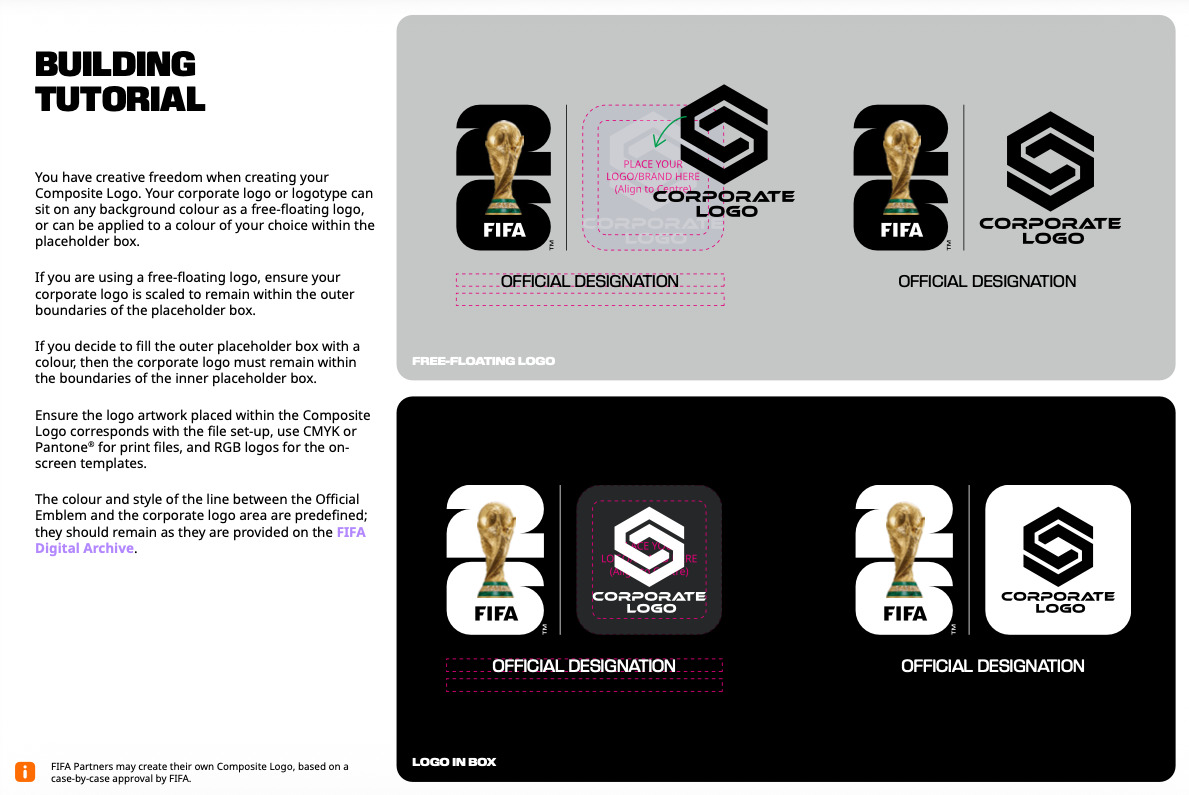

FIFA Brand Guide 2) Building Tutorial

Color plays a critical role in sponsor branding, especially in on-site environments such as booths and pop-up spaces.

Within the FIFA brand system, color is one of the few elements that allows sponsors to express their identity more clearly.

The Building Tutorial section of the FIFA brand guide explains how sponsor logos can be constructed within approved layouts, including the use of brand colors as background elements.

However, this is not a matter of free color choice.

All applications must follow predefined structures that preserve the overall World Cup visual hierarchy.

When a sponsor logo is placed within a box or container, that background may be filled with one of the brand’s official colors.

The logo itself must remain within the designated guide area, and its size, alignment, and positioning rules do not change simply because a background color is applied.

Building Tutorial Brief

- • Sponsor brand colors may be used as background colors when constructing logo containers.

- • Background color usage does not allow changes to logo size, position, or alignment.

- • The logo must remain within the designated guide area at all times.

- • Readability and contrast are critical; insufficient contrast with the FIFA emblem or official designation may result in revision requests.

- • Gradients, shadows, and texture effects are not permitted. Flat color usage is required.

- • Even when a boxed background is applied, clear space rules around the composite logo remain unchanged.

Background color is intended to support logo recognition, not to allow interference with surrounding graphic elements.

This approach is particularly effective in environments where immediate visibility is important, such as booths, OOH placements, and digital signage.

At the same time, the line between emphasis and overstatement remains narrow within official FIFA environments.

FIFA Brand Guide 3) Host Country Emblem

The 2026 FIFA World Cup introduces a unique visual system, as the tournament is hosted across three countries.

This structure extends into the brand system through the Host Country Emblem.

Each host country is assigned its own emblem variation, reflecting local identity while remaining part of the unified World Cup brand.

These emblems are designed to work within official environments without breaking overall consistency.

A key element of this system is color selection.

The three country codes—CAN, MEX, and USA—can each be emphasized using one of three predefined color tones assigned to that country.

For example, Canada is represented through three red tones, Mexico through three green tones, and the United States through three blue tones.

Sponsors may select from these predefined tones when applying the Host Country Emblem, but may not introduce additional colors or modify the emblem itself.

Host Country Emblem Brief

- • Host Country Emblems reflect the identity of each host nation while remaining part of the official World Cup system.

- • Each country code (CAN, MEX, USA) is assigned three predefined color tones.

- • Canada uses red tones, Mexico uses green tones, and the United States uses blue tones.

- • Sponsors may choose from the approved tones but may not alter colors beyond the defined options.

- • The emblem must be used in its approved format, with only the predefined color variations permitted.

This system allows sponsors to introduce a degree of regional relevance, particularly in on-site environments and localized applications.

When used correctly, Host Country Emblems can help brands connect more naturally with local audiences while remaining fully compliant with FIFA brand guidelines.

FIFA Sponsor Agency

As a FIFA sponsor agency, we work within the World Cup system on a day-to-day basis.

Having led World Cup branding for EA Sports in 2022 and now preparing World Cup marketing for Hisense as an official sponsor of the 2026 tournament, we continue to work closely with how the FIFA brand guide is applied in real sponsor environments.

This article was written from that perspective.

We hope this overview of the FIFA brand guide has been helpful for sponsors navigating both the opportunity and the practical constraints that come with operating inside official World Cup environments.

For brands planning activations around the FIFA Fan Festival, it is also worth considering how FFF operations differ by host city.

Our previous article on FIFA Fan Festival schedules looks at these regional characteristics in more detail and may provide additional context when planning localized executions.

FIFA Fan Festival Schedules: How FFF Operates by City

February 2, 2026

FIFA Fan Festival Schedules: How FFF Operates by City

For brands planning World Cup activations, the biggest challenge is not understanding the tournament itself, but understanding how each host city operates during it.

While the World Cup follows a single global calendar, FIFA Fan Festival schedules vary significantly by city. Each location operates on its own timeline, in its own venue, and at a different distance from the stadium. These factors directly shape how audiences move, how often they return, and how activation strategies should be designed.

For FIFA World Cup commercial partners (CPs), this is where real strategic decisions begin.

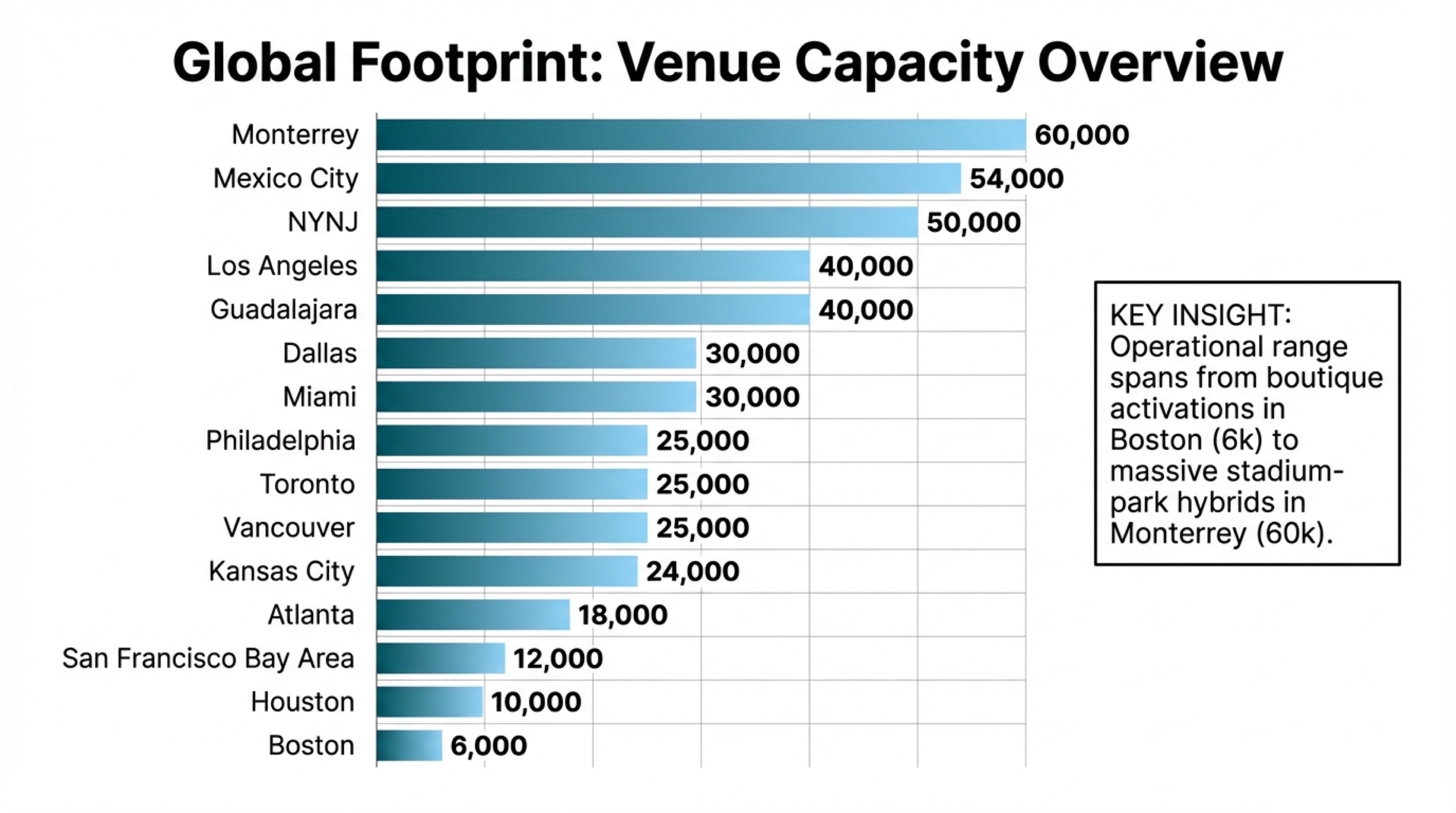

FIFA Fan Festival Schedules and Locations

During the World Cup, FIFA Fan Festivals are hosted across 15 cities, primarily in high-visibility public spaces such as central parks, waterfronts, and landmark squares.

What differentiates these cities is not just where the festival takes place, but how long it runs.

Some cities operate FFF for over a month, effectively turning it into a long-term urban destination. Others run short, concentrated schedules designed to absorb peak interest around key matchdays.

For CPs activating across multiple cities, these schedules determine whether repeat visitation is realistic, how often experiences and content need to refresh, and how budgets should be allocated across the tournament footprint.

A long-running city supports layered storytelling and modular installations. Short-run cities demand clarity, immediacy, and high-impact execution from day one.

City-by-City FFF Operating Windows

During the World Cup, FIFA Fan Festival (FFF) does not operate uniformly across all host cities.

While the tournament runs from June 11 to July 19, each city follows its own operating window within this period.

Long-Term Operations

Cities operating FFF for most of the World Cup period, functioning as sustained, multi-week destinations.

- • Operating period: June 11–July 19 (28–39 days)

- • Cities: Dallas, Houston, New York / New Jersey, Philadelphia, Guadalajara, Mexico City, Monterrey, Miami

- • Notes: Some cities include scheduled rest days, but overall support continuous engagement across the tournament

Selective Operations

Cities where FFF operates on selected matchdays rather than continuously, concentrating activity around peak moments.

- • Operating period: Select dates within June 11–July 19 (18–28 days)

- • Cities: Atlanta, Kansas City, Toronto, Vancouver

- • Notes: Audience flow shows clear peaks and valleys aligned with match schedules

Short-Term Operations

Cities concentrating FFF into short, high-impact windows early in the tournament.

- • Operating period: June 11–June 15 (4–5 days)

- • Cities: Los Angeles, San Francisco Bay Area

- • Notes: Function as sprint markets, prioritizing immediate visibility over long-term presence

For commercial partners (CPs), the World Cup is not a single six-week activation period.

It is a sequence of city-specific operating windows, each requiring a different level of commitment, pacing, and execution strategy.

How Far Are FFF Venues from Stadiums?

The distance between FIFA Fan Festival (FFF) venues and stadiums shapes how fans move, how long they stay, and how CP activations perform.

Across host cities, venue placement generally falls into a few clear patterns.

Walkable Distance

In some cities, FFF venues are located within walking distance of stadiums, capturing strong pre- and post-match foot traffic.

- ✔️Atlanta – Centennial Olympic Park, approx. 5-minute walk

- ✔️Toronto – Fort York / The Bentway, approx. 12-minute walk (with trolley access)

These cities favor matchday-driven engagement and benefit from precise timing aligned with kickoff and final whistles.

Transit-Connected

Some cities place FFF farther from stadiums but maintain access through public transportation.

- ✔️Seattle – Seattle Center, approx. 3.2 km via public transit

Here, audiences arrive intentionally, shifting focus from match timing to on-site experience quality.

Transit-Centric Metro Areas

In large metropolitan regions, stadiums and fan festivals are connected through multi-modal transit systems.

- ✔️New York / New Jersey, Dallas, Philadelphia

These cities extend activation opportunities beyond the festival site into transit corridors and OOH touchpoints.

Destination-Based

Some FFF venues function as standalone urban destinations rather than matchday extensions.

- ✔️Miami – Bayfront Park, approx. 14 miles from Hard Rock Stadium

These cities rely less on matchgoing fans and more on tourists and local foot traffic, requiring CP activations to stand on their own.

Why FIFA Fan Festival Schedules Matter for CPs

FFF schedules and stadium proximity define more than logistics. They shape who shows up, why they come, and how long they stay.

A walkable, long-running city supports sustained engagement and repeat exposure.

A distant, short-run city rewards bold visuals and concise storytelling.

For CPs, treating all fan festivals the same risks underperforming everywhere.

As the global experiential marketing partner of Hisense for the 2026 World Cup, Eidetic approaches FIFA Fan Festival planning not as a single global activation, but as a sequence of city-level decisions shaped by time, distance, and audience flow.

The most effective World Cup strategies are built city by city—aligning activation formats with local schedules, spatial dynamics, and audience behavior.

Read More: World Cup Sponsor Guide